Do you want to know when you are eligible to retire? Are you wondering what formulas are used to calculate your retirement benefit? These are among the most common questions classified employees ask.

As an employee of Calexico Unified School District, you are part of the CalPERS retirement program. The California Public Employees’ Retirement System (CalPERS) is an agency in the California executive branch that manages pension and health benefits for more than 1.5 million California public employees.

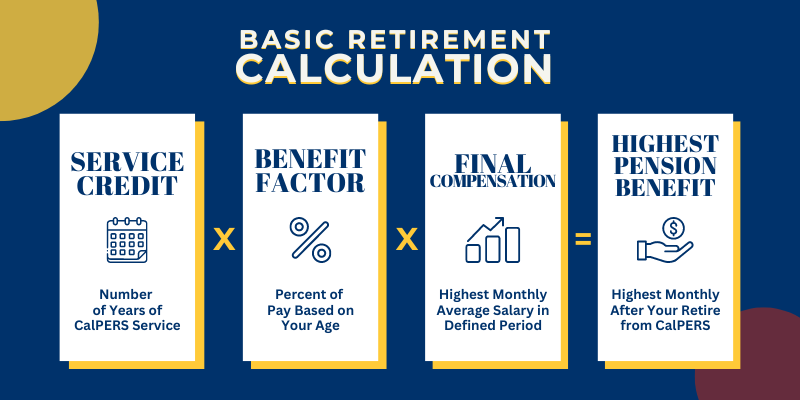

Your retirement benefit is based on a retirement formula using the following criteria:

- Total service credit

- Age at retirement

- Highest average annual compensation (12-month or 36-month consecutive period)

You may have more than one retirement formula based on your membership date, your membership category, and your employer’s contract with CalPERS.

Eligibility Requirements for Retirement

Your minimum retirement age depends on your retirement formula:

*50, 52, or 55 Note: If you have a combination of classic and PEPRA service, you may be eligible to retire at age 50

The minimum service requirement is five years, or 10 years if you are a State of California Second Tier member There are exceptions to the minimum service requirement:

- You’ve worked at least five calendar years as a permanent part-time employee (Government Code section 20970)

- You’ve established reciprocity with another California public retirement system Refer to the publication A Guide to CalPERS When You Change Retirement Systems (PUB 16)

Basic Retirement Calculation

The key to calculating your retirement benefit is to understand how service credit, age, and final compensation are used in the basic retirement calculation Increase any one of these factors and you’ll increase your overall benefit. The basic retirement calculation is shown below:

Service Credit

Service credit is earned on a fiscal year basis, which is July 1 through June 30. If you are paid every month, 10 months of full-time employment will equal one year.

You cannot earn more than one year of service credit in one fiscal year. If you work less than eight hours per day, it will take you longer to earn a year of service credit.

Check the pdf file below to see a cheatsheet charts PDF file. It contains two charts that show the benefit factor increases and the percentage of final compensation you will receive.

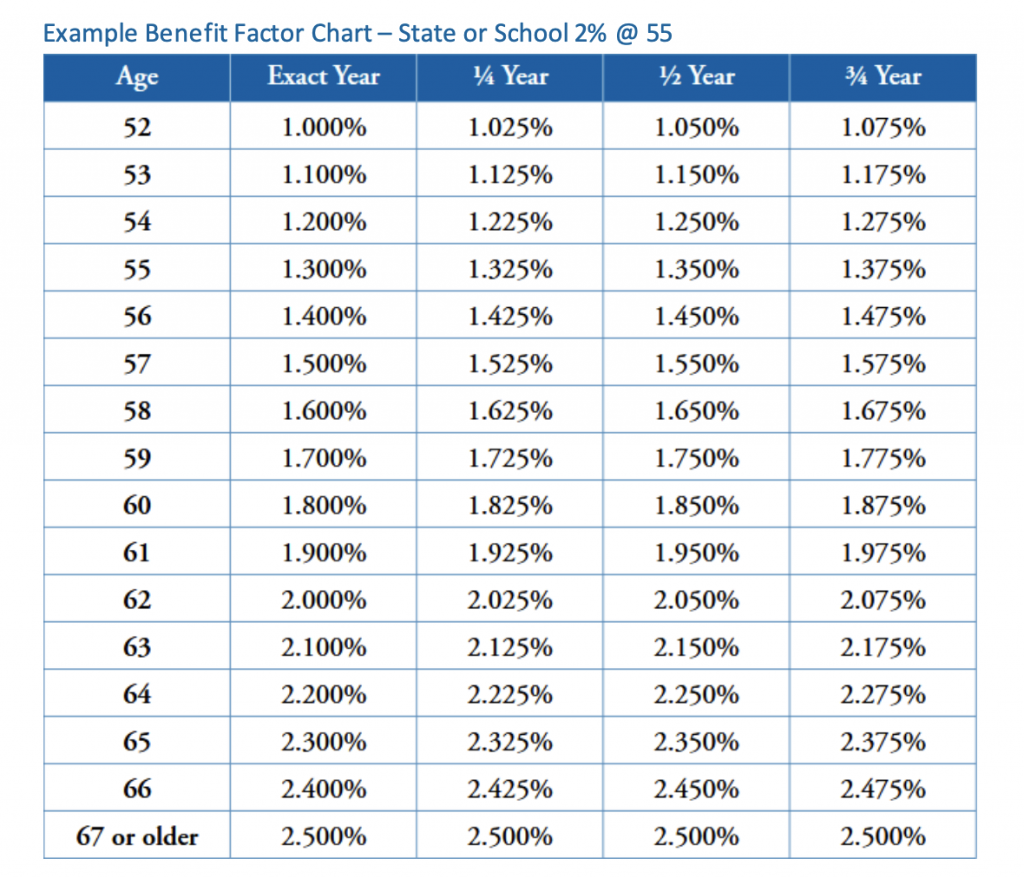

Benefit Factor

Your benefit factor, also known as the “age factor,” is the percentage of pay you’ll receive for each year of service credit earned. It is determined by your retirement formula and age at retirement.

Starting at your minimum retirement age, your benefit factor increases every quarter year up to a maximum age. For example, if your retirement formula is 2% at 55 and you retire at age 55, you will get 2% for each year of service credit. The percentage increases every quarter after age 55 up to the maximum age of 63.

View Benefit Factor Charts Online

Go to www.calpers.ca.gov/benefitcharts to find the retirement formula charts for your benefit factor and final compensation

Retirement Planning Checklist

As you plan for your retirement and get ready to submit your retirement

application, use the following checklist as a reminder of what you need to

consider You can find a detailed checklist with links to all our retirement

planning resources at www.calpers.ca.gov/retirementchecklist

In Conclusion

As you can see, retirement planning might sound scary. Make sure you talk to your CSEA representative and ask for advice on the process. This article is just to show you an overview of the rights and tools that we as CSEA employees can utilize to fight for your rights.